Key points:

- United Methodist general agencies are developing their spending plans for the coming year, but that work is tricky as the denomination deals with the ongoing fallout of COVID, high inflation rates and rising church disaffiliations.

- While revenue through giving has exceeded expectations in recent years, the church’s finance agency continues to take a conservative stance on budgeting due to the uncertainty.

- Agencies are working to ensure denomination-wide ministries continue while also taking into account the financial strain faced by congregations and conferences across the connection.

The United Methodist Church’s general agencies are deep into developing their spending plans for the year ahead, and the process is more complicated than ever.

Agency staff are trying to figure out what to budget for such line items as local church training, church-planting resources, disaster response, mission work and the employees who carry out these ministries around the globe.

But it’s hard to know how much you can spend, when the revenue side of the ledger mainly shows a bunch of question marks.

“Our challenge is to be realistic about our resources while not allowing our anxiety about decline to pre-emptively limit what God wants us to do,” said the Rev. Kennetha Bigham-Tsai, the chief connectional ministries officer of the Connectional Table. She is the top executive of the leadership body that coordinates the denomination’s mission and ministry, including programmatic agency work.

In this time of uncertainty, the General Council on Finance and Administration — the denomination’s finance agency — has been advising fellow agencies to budget with lower giving in mind. However, actual giving has exceeded the finance agency’s expectations during the pandemic, and some agencies have been able to take advantage of that by doing more ministry than would have been possible under the lower recommendations.

The General Council on Finance and Administration typically has a good track record in predicting giving rates. The fact that the finance agency’s recommendations are more conservative than actual giving is a reflection of how difficult planning is in the current environment. It also points to a tension in the budget process.

Subscribe to our

e-newsletter

“In our conversations with GCFA, we try to bring a missional focus that recognizes the reality of reduced funding while also pointing to the abundance of God’s promise,” Bigham-Tsai said.

Both the Connectional Table and the General Council on Finance and Administration help guide agencies’ annual budgeting process. The finance agency’s board has final approval of agency spending plans when it meets each fall.

No one doubts The United Methodist Church is facing uncertainties that would have many accountants grabbing for their antacids.

United Methodist churches, annual conferences and the general agencies that serve the whole denomination are all feeling the financial strain of the global pandemic, tumultuous stock markets and rising inflation.

In addition, The United Methodist Church is dealing with an ongoing splintering following longtime debate over LGBTQ inclusion and the launch of a breakaway theologically conservative denomination. The last year has seen a rising number of churches withdraw from the denomination.

That leaves all United Methodist ministries that rely on church giving for revenue — including the Connectional Table and 10 of the denomination’s 13 general agencies — doing a lot of guesswork on what to expect from offering plates in the near future.

Complicating matters is that COVID has now caused three postponements of General Conference, the international denomination’s top lawmaking assembly, which typically sets the denominational budget every four years.

Funding for the denomination’s budget largely comes from apportionments paid by U.S. annual conferences. The regional bodies in turn ask for apportionments — shares of giving — from local churches.

The next General Conference is now scheduled for 2024. In the meantime, by church law, the denomination is still operating under the budget passed by the 2016 General Conference.

However, many annual conferences are already paying their apportionments based on the significantly lower budget the General Council on Finance and Administration had submitted to General Conference in 2020, before COVID-caused shutdowns.

“I think that trend towards that smaller budget is going to continue because I think the long tail of the COVID financial impact is going to last,” said Brant Henshaw, president of the denomination’s National Association of Annual Conference Treasurers. He is also treasurer for both the Alaska and Pacific Northwest conferences.

Many annual conferences are restructuring and reducing staff in this time of upheaval.

“Reimagining at the general church level — just as the annual conferences are reimagining and local churches are reimagining their budgets — is going to continue for some time,” Henshaw said.

Agencies supported by church giving

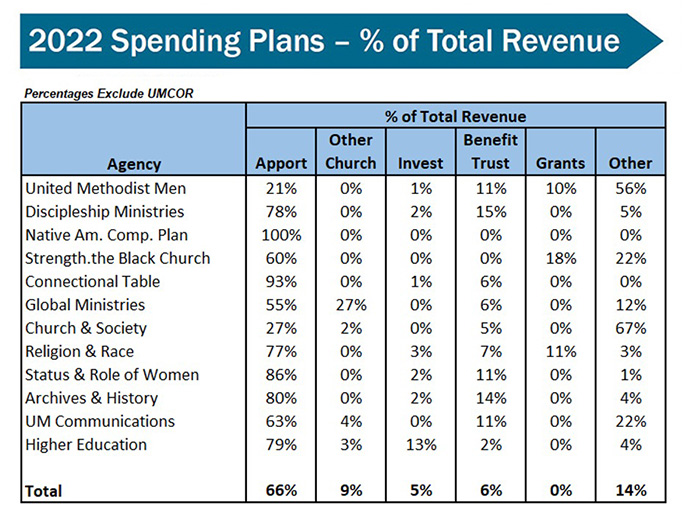

Ten of 13 general agencies rely on apportionments — shares of giving — for at least some of their revenue.

Those agencies are the General Council on Finance and Administration, Archives and History, Church and Society, Discipleship Ministries, Global Ministries, Higher Education and Ministry, Religion and Race, Status and Role of Women, United Methodist Men and United Methodist Communications. UM News is part of United Methodist Communications.

Wespath, the denomination’s pensions agency, the United Methodist Publishing House and United Women in Faith are all self-supporting.

The denomination’s general agencies also have made cutbacks, reducing their full-time staff by about 25% over the past three years either through layoffs or by leaving positions vacant.

Roland Fernandes, the top executive of the United Methodist Board of Global Ministries, said the mission agency reduced its staff in 2018-2020 before COVID struck in anticipation of the lower budget coming before General Conference delegates.

But even with fewer employees, agencies are trying to stay true to their mission.

“We have to tend to the needs of those working to spread the gospel and transform the world,” said Dawn Wiggins Hare. She is the top executive of the United Methodist Commission on the Status and Role of Women and the convener of the General Secretaries Table that brings together the top executives of the denomination’s general agencies.

“Ministry does not stop because there are disagreements within a family.”

Agency leaders point to successes that they attribute in part to flexibility in a time of uncertain revenue. Examples include Global Ministries’ immediate response to help churches house people displaced by the invasion of Ukraine, Discipleship Ministries’ development of resources to address Christian Nationalism, and the new “Do No Harm” guide from the Status and Role of Women to help victims of sexual misconduct.

North Katanga Area Bishop Mande Muyombo said the agencies are carrying out ministries across the denomination, including on the continent of Africa.

He pointed to such efforts as Religion and Race providing training on issues of tribalism including organizing a reconciliation conference for Bantu and pygmy peoples. Other examples he cited include Higher Education and Ministry’s leadership development, Discipleship Ministries’ local church training, Church and Society’s civic education, Status and Role of Women’s help with sexual ethics, United Methodist Communications’ extension of internet access and Global Ministries’ supply of missionaries and support for health and agriculture.

“Personally, I believe that the general agencies are strengthening our ministries,” said the bishop, who is the Connectional Table’s incoming chair.

Here is how these agencies’ annual budgeting process works in this fraught time.

Step 1: General Conference

It all starts with the denomination-wide budget passed at the most recent General Conference.

The delegates approve how apportionments are to be allocated among the general agencies, the bishops and other general church ministries.

General Conference also approves the base percentage used to calculate apportionments requested from annual conferences.

In the U.S., the formula for determining an annual conference’s apportionments is its total local church net expenditures multiplied by the General Conference-approved base percentage. Net expenditures are what a church spends after capital expenses, apportionments and benevolent giving. About 90% of giving remains in the local church.

Because of the formula, the budget General Conference passes is always a rough estimate.

Put another way, General Conference decides how the denomination’s financial pie is to be sliced — but the size of the pie itself can vary year-to-year.

When a conference’s total local church spending declines, so do the apportionments requested. The General Council on Finance and Administration, which administers general church funding, adjusts the amount apportioned to each conference annually based on the most recent data available.

In 2023, the finance agency is asking annual conferences to pay lower apportionments because total local church net expenditures declined in 2020 as a result of both the pandemic and church disaffiliations.

Step 2: Estimating collections each year

Just as the amount of apportionments requested is a moving target, so is the percentage that the General Council on Finance and Administration expects to collect from annual conferences.

General agencies never budget with the expectation of receiving 100% of apportionments.

Each summer, the finance agency recommends a collection rate agencies should use in developing their spending plans. The finance agency bases its recommendation on economic data and surveys of annual conferences.

Usually, the finance agency recommends agencies prepare spending plans based on an 85% to 90% apportionment collection rate.

Help for agencies facing tight budgets

The General Council on Finance and Administration board recently approved a change with an eye toward helping agencies in this time of tight budgets.

At its online meeting Sept. 30, the board voted to adjust the distribution of the Benefit Trust, used by agencies to cover the employer costs related to active and retiree health care plans.

General Conference, the denomination’s top lawmaking body, established the Benefit Trust in 1996 as a wasting trust. That means its assets are depleted over time as the agencies receive their payouts. The Benefit Trust has an annual distribution that typically increases by 2% every 15 years.

The distribution is currently at 6% of the previous year’s ending balance and was originally set to increase to 8% in 2027.

The GCFA board on Sept. 30 voted to move up the rate of distribution to 8% starting next year and delay the next distribution increase to 10% from 2042 to 2046.

As a result of the move, GCFA and Wespath staff said, agencies will receive roughly the same amount of financial help for benefits next year as in 2022. Modeling also shows that when the distribution schedule resumes in 2046, the effect on the fund balance will be negligible.

Read General Council on Finance and Administration press release.

But that has all changed in recent years. For 2020 spending plans, GCFA advised fellow agencies to budget based on a 70% apportionment collection rate. For 2021 — after giving plummeted amid COVID shutdowns and most agencies had received federal Paycheck Protection Program funds — the finance agency recommended budgeting for only 50% collections. For planning this year, the recommendation was 60-65%.

For 2023, the finance agency is cautioning that spending plans should be based on anywhere between 50% and 70% apportionment receipts. To compensate for reduced revenue, agencies typically dip into their reserves.

So far, giving each year has exceeded these low recommendations. However, apportionment receipts have dropped for three straight years. The World Service Fund, which supports the work of most general agencies, saw a collection rate of 72.5% last year — the lowest since 2005.

That’s also well below the 84.2% collection rate the fund saw in 2009 during “the Great Recession.”

“GCFA has been providing guidance during a period of great uncertainty ranging from the economic impact of a pandemic on all levels of the church to the ramifications of a church split/disaffiliations,” Brandy Bivens, the agency’s chief officer of communications, said by email. “Each year, GCFA gives advice based upon what it knows at that time.”

As of the end of August, general-church apportionment receipts were slightly up compared to this time last year. However, the denomination is still on track to see overall collection rates remain below 80%, Rick King — GCFA’s chief financial officer — recently told the agency’s board.

Hare, the convener of the General Secretaries Table, said all agencies have worked during this time period to reduce overhead to be able to maximize capacity of developing and delivering resources, programs and services.

“Reduction of budgets can ultimately mean streamlining and even reduction of personnel,” she said. “When your programs are your people, the delivery of ministries can be directly affected and the uncertainty can weigh heavily on staff affecting morale. We have all been challenged to live into our faith in setting our budgets.”

However, she also stressed that “United Methodists are a faithful people as receipts have exceeded predictions in each of these last years.”

Step 3: Getting needed approvals

Each agency’s spending plan needs the approval of its own board, the Connectional Table and finally the board of the General Council on Finance and Administration.

This month a joint group of Connectional Table and GCFA board members are meeting with each agency’s leaders to review financial statements and spending-plan narratives. GCFA provides the financial forms agencies need to complete. The Connectional Table provides guidance on the narratives, which focus on the programmatic goals.

Bivens of GCFA stressed that agencies need not stick with the finance agency’s recommended collection rate in developing their spending plans. However, if an agency uses a higher rate, GCFA staff will review to ensure that the agency has adequate reserves if giving falls short of the more optimistic collection rate.

By the time the GCFA board votes in late November, each spending plan already has undergone multiple reviews.

In every step of the budgeting process, agencies focus on carrying out their General Conference-mandated ministries while keeping in mind the financial pressures faced throughout the denomination.

“I am honored and continually amazed that God has allowed me to be in a space with passionate leaders dedicated to particular areas of ministry that form the beautiful body of the church,” Hare said. “We complement and complete one another.”

Hahn is assistant news editor for UM News. Contact her at (615) 742-5470 or newsdesk@umnews.org.To read more United Methodist news, subscribe to the free Daily or Friday Digests.