Key points:

- The United Methodist Church’s pension and benefits agency is asking General Conference to authorize a new retirement program for U.S. clergy.

- The proposed changes in the new Compass plan do not affect current retirees nor the benefits current clergy already have accrued.

- Nevertheless, Wespath staff say change is needed for the continued sustainability of United Methodist retirement benefits.

- The proposal was already in the works before the recent wave of disaffiliations.

U.S. United Methodist clergy could see significant changes to their retirement benefits under a proposal going before General Conference delegates this month.

Staff at Wespath Benefits and Investments — The United Methodist Church’s pension and benefits agency — are quick to point out that clergy who have already retired or are about to retire in the next two years will see no changes in their benefits. Current clergy members also will keep whatever retirement benefits they already have accrued.

However, staff are also clear that Wespath’s proposed Compass plan would mean benefit changes going forward. Unlike previous clergy retirement plans that Wespath has offered over the past 100 years, Compass does not include a lifetime benefit. Instead, Compass is entirely a defined-contribution plan similar to the 401(k) plans most U.S. corporate employees now have.

Wespath is asking General Conference voters to authorize replacing the current U.S. clergy retirement program with the new Compass plan, starting in 2026. The international denomination’s top policymaking body will consider the proposal when it meets April 23-May 3 in Charlotte, North Carolina.

Wespath staff members stressed during an April 10 online event that the switch to the Compass plan is needed to continue providing reliable and sustainable retirement income.

“A change in retirement plans is not something you do lightly,” said Dale Jones, Wespath’s managing director of church relations.

“It’s a lot of work for us. It’s a lot of work for the benefits folks in the annual conferences. It’s a challenge for all of our clergy participants. But as our board of directors looked at trends in the church, over time, they became more and more convinced that it was important that we move to a different type of retirement plan than what we’ve had historically.”

In operation since 1908, Wespath is one of the world’s largest faith-based pension agencies. The nonprofit serves more than 100,000 retired and active clergy and other church staff, and more than 150 United Methodist-related institutional investors. As of the end of 2023, Wespath managed about $26 billion in assets.

The self-supporting agency manages investments for pensions and other retirement-plan assets on behalf of United Methodist annual conferences — church regional bodies consisting of multiple congregations and other ministries. Annual conferences are the plan sponsors and legally responsible for paying benefits.

With the Compass plan, Jones said, Wespath is trying to provide adequate retirement income for clergy across the spectrum of compensation and categories of United Methodist ministry.

“But for the sake of conferences that are responsible for sustaining the retirement benefits for their clergy,” Jones added, “the key objective was a plan that was sustainable and affordable, that the church could continue to support for the long term.”

Learn more

Wespath has put together an infographic to explain the proposed Compass plan going before General Conference delegates.

People can read the legislation that would create Compass in Petition 20946, which is on pages 1,451 to 1,484 of the Advance Daily Christian Advocate.

The agency also hosted two Live From Wespath segments that discuss different aspects of its ministry. Information on Compass is included in both segments:

After decades of shrinking U.S. membership and the resulting financial pressures on annual conferences, Jones and other Wespath staff say change needs to happen.

Wespath’s current Clergy Retirement Security Program combines both defined-contribution and defined-benefit components.

A defined-benefit plan provides a monthly pension payment for life, with the employer (in this case, annual conferences) assuming the investment risk. A defined-contribution plan — like a 401(k) plan — provides an account balance to use during retirement, with the clergyperson assuming the risk of sustaining the money through the end of his or her lifetime. United Methodist lay employees already rely on defined-contribution retirement plans.

Frederick Hyland, Wespath’s managing director of actuarial services, said the designers of Compass sought to achieve five goals: sustainability, affordability, adequacy, equity and flexibility.

“We want to make sure that the benefits that the program generates in conjunction with Social Security are enough to supply participants with an income that allows them to live comfortably in retirement,” he said. “The trick or the rub here is that you need to balance affordability with adequacy to make sure that is calibrated properly in order for sustainability to exist.”

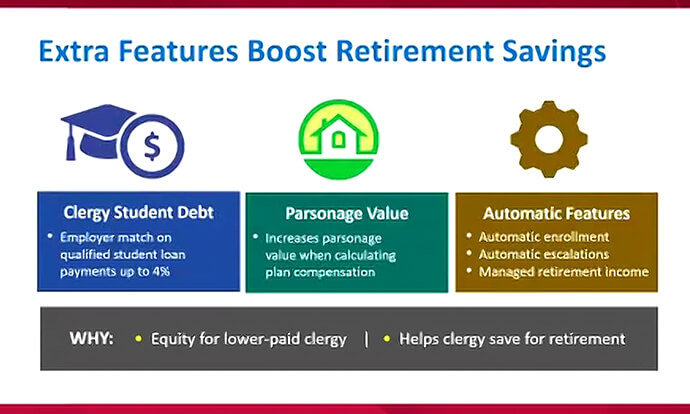

Hyland said that Wespath also plans to continue its longstanding value of equity — “making sure that all clergy regardless of their pay level receive an adequate income in retirement.”

Under Compass, U.S. annual conferences — the plan sponsors — will make three kinds of contributions toward their clergy members’ retirement.

Those contributions are:

- $150 per month, which will increase by 2% each year after 2026.

- 3% of the clergy member’s pay.

- $1/$1 match on up to 4% of the clergy member’s pay.

The $150 is intended to be a base level of benefits per month to more fairly distribute benefits than a solely pay-based plan.

Hyland said Compass is also intended to help address clergy student debt.

Wespath and breakaway church

During the April 10 livestream event, Wespath staff addressed its relationship with the Global Methodist Church that broke away from The United Methodist Church in May 2022.

Since then, the new theologically conservative denomination has recruited its membership largely from churches disaffiliating from the United Methodist fold.

Wespath Benefits and Investments initially provided a separate defined-contribution retirement plan as well as death, disability and health benefits for Global Methodist Church clergy and lay staff.

If approved, Compass will provide matching contributions on qualified student loan payments made by clergy. In essence, the plan treats a clergy member’s student loan payments as if they are participant contributions, and then provides an appropriate match as if such payments had been participant contributions to the plan.

“Many clergy often debate between paying off their student loans and putting money into the plan and starting their retirement savings,” Hyland said. “We think that’s an unfair debate to have.”

Compass also includes automatic enrollment for clergy for at least 4% in personal contributions, which is what qualifies for the full match. Under the plan, clergy automatically would see their personal contribution increase by 1% a year up to the maximum set by the conference. Clergy could opt out of these automatic features any time.

Another significant difference between pensions and defined-contribution plans is what happens when a clergyperson dies. Under pension plans, the benefits typically stop. Under defined-contribution plans, whatever remains in the clergyperson’s retirement account can go to beneficiaries. Hyland said this is what makes Compass more flexible.

But one question many clergy had during Wespath’s livestream event was how to ensure their retirement income would last throughout their lifetimes.

To address that concern, Wespath has developed the award-winning program LifeStage Retirement Income. The program uses an algorithm designed by investment and benefits professionals to inform participants how much they can take out without the risk of outliving their retirement funds.

Wespath also includes two other optional programs for retirees.

- Social Security Bridge uses more savings early in retirement so participants can defer applying for Social Security benefits until full retirement age or later.

- Longevity Income Protection involves the purchase of a deferred annuity that would make payments guaranteed for life beginning at age 80.

Wespath was already designing the Compass plan before the turbulent 2019 special General Conference and the wave of U.S. church disaffiliations that followed under legislation approved at that meeting. More than 7,600 churches — or about a quarter of the U.S. congregations the denomination had in 2019 — have withdrawn under that provision, which expired at the end of 2023.

Subscribe to our

e-newsletter

While the disaffiliations were not the main reason behind Compass, Jones said they do add to the proposal’s urgency.

Overall, Compass is slightly less generous but also less costly than the current Clergy Retirement Security Program, he said. Critically, the new plan also does not generate additional long-term liabilities for annual conferences.

“It’s a plan that we believe the church can sustain for the long term, as opposed to the current plan, which we think may not be sustainable for the long term,” Jones said. “So I would say the advantages really are assurance that there would be an adequate retirement benefit provided for clergy for decades yet to come, versus some concern that that might not be feasible, if we didn’t make a plan change.”

Hahn is assistant news editor for UM News. Contact her at (615) 742-5470 or newsdesk@umcom.org. To read more United Methodist news, subscribe to the free Daily or Friday Digests.